Does bitcoin investing make sense? Exploring the high-level case (part 2)

April 2, 2021

Part 1 of this series started exploring the key points a 'reasonable investor' should consider in order to make an opinion on bitcoin investing. We identified five points to summarize the case for considering bitcoin in 2021 as part of a diversified portfolio.

Five key points

- Macroeconomic backdrop: there is brutal and considerable monetary inflation worldwide, i.e. a vast increase of newly created money in people's pockets. As a result, there are suddenly more Dollars, Euros or Pounds chasing the same amount of goods (e.g. food) and raw materials (e.g. copper), assets (e.g. stocks), and stores of value (e.g. gold, art, jewellery). This imbalance tends to depreciate these currencies and generate inflationary tendencies.

- Limited supply: when it comes to stores of value, one can make a case for bitcoin as 'digital gold' and therefore as its modern-day substitute or complement.

- Intrinsic value: Bitcoin (the protocol) has an intrinsic value as a means of wealth/money transfer, and subsequently, so does bitcoin as an integral part of this protocol.

- Increasing demand: Bitcoin is gaining traction amongst institutional investors, leading to a rise in demand. Furthermore, as a result of the way the bitcoin supply is pre-programmed, there is a four-year price pattern expected to peak later this year.

- Strong security: the Bitcoin protocol has not been broken once since its inception in 2009. Besides, there are now reasonably robust ways to store the 'proof of ownership' of your bitcoins securely.

The first post covered points 1 and 2. This post will cover points 3 to 5. We stay at a high level in both articles. Subsequent write-ups will cover each of these five points in more depth.

Jump Straight to:

- Point 3 - The value of bitcoin

- Point 4 - Increasing demand and bull run this calendar year

- Point 5 - the Bitcoin protocol is robust, and the risk of theft or loss of bitcoins is now essentially a function of individual carefulness or carelessness.

Point 3 - The value of bitcoin

The Bitcoin protocol has value as a peer-to-peer electronic payment and wealth/money transfer protocol. Subsequently, the bitcoin token inherits some of this value as an integral and necessary part of this protocol.

Value of the Bitcoin protocol

It is hard to put a price tag on the protocol but, contrary to what some say, it cannot be zero as it provides a utility, namely a wealth/money transfer service that has been used continuously since 2009.

A transfer from one party to another is straightforward. The settlement takes about ten minutes for a one-block confirmation (if one wants to be absolutely sure of the transfer, one can wait about 60 minutes for six successive new blocks, all confirming the transaction). This timeline compares very favourably to bank transfers and particularly international wire transfers, which take several days to settle. The Bitcoin process is not efficient for high-volume small transactions (e.g. buying coffee), but it works very well to transfer large to very large sums and is not hindered or limited by international borders. An electronic place of exchange somewhere in the world will then be needed should conversion to fiat currencies be desired. As of this writing, there are about 130 cryptocurrency exchanges worldwide (including Coinbase—soon to be listed on the Nasdaq). Other players can also convert bitcoin to fiat (e.g. PayPal, bitcoin ATMs, etc).

Besides, one can access his bitcoins anywhere in the world as long as he has the private key (the private key is the 'proof of ownership' as explained in point 5 below). It, therefore, makes it possible to carry around a small fortune incognito. By comparison, one can try using public transports to move five or ten gold bars from one place to another in a major international city. Ending the journey alive and with all of the gold bars present and accounted for will be a significant feat.

Understanding the validation step

A crucial part of the settlement process is the validation—and subsequent addition to the blockchain—of a block of transactions. The validation step deals with and avoids the double-spending problem whereby the same bitcoin would be spent twice.

To validate transactions and add a new block, one needs to solve a mathematical problem that requires—as of March 2021—considerable computing power. This problem is essentially a trial and error effort, and the more trials you can make per second, the more chances you have to find the correct answer. This step requires expensive specialized hardware (Application Specific Integrated Circuits or ASICs for short) and electrical power. In addition to computing power, one also needs luck to be the first to solve the mathematical problem. The first validator to solve the problem gets rewarded with new bitcoins (6.25 bitcoins per block in 2021) that are automatically created/minted to reward those validators/miners.

One can understand why these transaction validators are called miners: they invest in hardware and energy to validate transactions and 'extract' new bitcoins as a reward. This is very similar to investing in tools and human resources to extract copper, gold, or other minerals from Earth's crust.

Value of bitcoin

We can now articulate why the value of bitcoin (lowercase 'b') cannot be zero.

First, as we have seen above, the token is an integral part of the wealth/money transfer protocol. It is the reward attached to having demonstrated completion of the required computing effort associated with validating transactions (called 'Proof of work'). If the process as a whole has a utility and, therefore, a non-zero value, then its validation step and its associated token must have some value. Specifically, it is the value attached to avoiding double-spending and securing the network.

If we look at it another way, 'miners' have chosen to be in the business of validating transactions. While it might have been a high-conviction activity in the early days, it is now a for-profit business. 'Miners' use fiat currencies to buy hardware and energy in order to get new bitcoins. In order words, they are in the business of profitably swapping fiat currencies for newly minted bitcoins. This gives a value to the newly minted bitcoins that is certainly not zero. The critical reader might suggest that miners immediately convert back their new bitcoins into fiat currencies. However, on-chain records show that they seem to keep most of their new bitcoins and only convert what they need to cover the operating and Capex costs mentioned above.

In summary of section 3, bitcoin cannot have zero value.

Point 4 - Increasing demand and bull run this calendar year

Nascent institutional interest and effective investment allocation are driving up demand for bitcoin.

-

Select large companies started including bitcoin on their balance sheet in late 2020 and early 2021 (e.g. MicroStrategy, Tesla, Square). A list is maintained here.

-

Family offices and prominent investors (e.g. Paul Tudor Jones, Stan Druckenmiller) joined the fray

-

Large Wall Street firms started either recommending investors to consider a small allocation (e.g. JPMorgan Chase) or started facilitating and making possible such an allocation (e.g. BNY Mellon)

Assessing the price impact of wealthy investors and institutional players demand is difficult, but 'back of the envelope' calculations can at least give an idea:

-

Based on Credit Suisse Global wealth report 2020, there are about twenty million millionaires worldwide with combined assets of about US$128 trillion. If half of these millionaires (with the same wealth distribution as the whole twenty million of them) were to hold 5% of their assets in bitcoin, this would imply a bitcoin price of about US$ 170,000.

-

Based on an interview of Cathie Wood (ARK Invest) on CNBC, if half of all US corporations were to put 5% of the cash on their balance sheet into bitcoin (Tesla did put 10%), it would increase the bitcoin price by an additional US$ 50,000. Note that this only includes US corporations.

The bitcoin price is in a bull run expected to peak later this year.

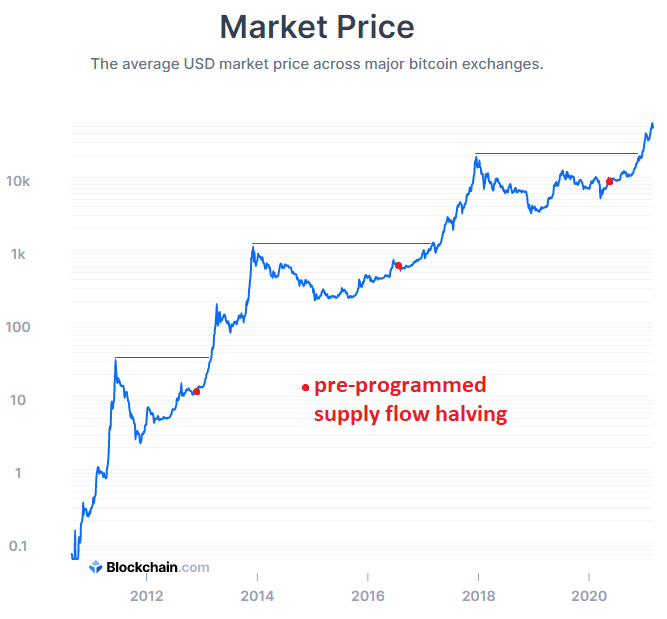

When plotting the bitcoin price since inception on a logarithmic scale, a clear four-year pattern emerges.

It is linked to the pre-programmed 'halving' occurring about every four years. A 'miner' successfully verifying a new block of transactions is rewarded in bitcoins. However, the protocol is programmed so that this reward decreases regularly once a certain number of new blocks have been added to the chain i.e. once the demand for transactions has grown sufficiently. Historically, this happened about every four years, and it translates into a planned but sudden reduction in the supply and flow of new coins in the face of constant or growing demand. This imbalance pushes up the price. As it happens, 2021 is a 'bull' year for this price pattern.

Click here for a larger image (pop-up window)

To summarize point 4, one can see that the price target potential is high and certainly in the hundreds of thousands of US$ in the long run.

Point 5 - the Bitcoin protocol is robust, and the risk of theft or loss of bitcoins is now essentially a function of individual carefulness or carelessness.

A robust protocol—albeit with a low but non-zero transitory geographical risk

The Bitcoin protocol has been working flawlessly since 2009. Furthermore, while exchanges have been hacked and the bitcoins of individual investors have been stolen, the Bitcoin protocol itself has never been hacked.

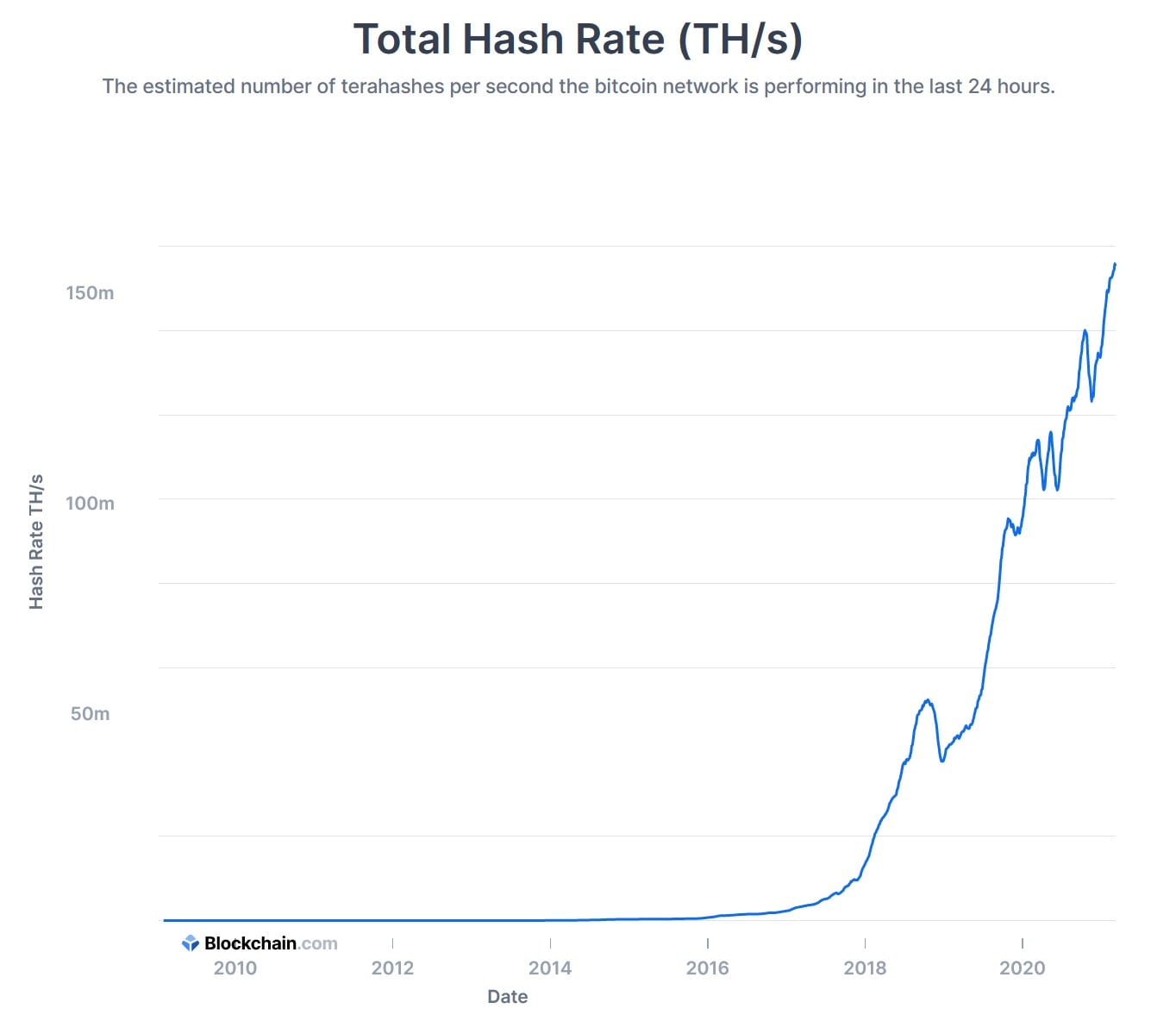

A cryptocurrency's security is tied to the computing power networked together that constantly operates to verify transactions. A measure of the computational power required to process bitcoin transactions is called the 'hash rate'. It has been increasing exponentially since 2009 to the point where the computers networked together on the protocol consume roughly as much electricity as a small country.

Therefore, the cost of an attack on the protocol is enormous in procuring the hardware (which is in short supply) and power requirements.

Click here for a larger image (pop-up window)

This point would not be fully complete without mentioning a low but non-zero risk. The computing power validating the network (the 'hash rate') is 65% concentrated in China. Indeed, there is a historical oversupply of electricity in this region, leading to low electricity prices and more profitable mining operations.

A decentralised network with a validation step 65% concentrated in a single country does not appear ideal. We, therefore, need to look at this in more details. We will stick to the headline conclusion here with an in-depth separate article later to limit this article's length. In the meantime, the concerned reader can make his own opinion by listening to this 45-minute long interview of Mustafa Yilham, VP at Bixin, a China-based mining entity.

An analysis of the risks attached to this geographical concentration leads to the following conclusions:

- The miners themselves have no reason or interest to misbehave: they own many bitcoins, and their sole business is … the Bitcoin process.

- The Chinese state seizing and retiring the mining rigs will not be problematic: the total global 'hash rate' will be lower for a period till other miners elsewhere in the world switch on new hardware.

- There is no issue with the Chinese state trying to steal bitcoins through a 'double spend attack': China can raise much more money in an easier way than accumulating stolen bitcoins!

- There is a low but non-zero risk attached to the Chinese state deciding to disrupt the Bitcoin process. It requires Chinese authorities to successfully realise three conditions: simultaneously seizing and controlling the huge majority of the China-based mining rigs and performing a sustained and prolonged disruption by using its dominant hash power to keep adding e.g. empty blocks. This attack would effectively prevent any actual transaction from being validated in a scenario reminiscent of the recent Suez Canal blockage by the 'Ever Given' with a growing backlog of transactions waiting for validations.

To dampen excessive concerns, one would think that there are probably technical solutions already prepared by the Bitcoin community, e.g. 'blacklisting all mining rig addresses based in China'. Besides, the window of opportunity for such a disruption will close soon. First, US or European mining businesses now enjoy the structural advantage of ultra-low financing costs over Chinese miners (FED benchmark rate 0.25% vs PBC 3.85%). As a result, most newly built mining rigs are shipped to miners outside China, specifically North America. Second, we note that the geographical concentration had already decreased from the levels of Q3 2019, when 75% of the 'hash rate' was based in China (it is now 65%).

In summary, we conclude that the Bitcoin protocol has been working flawlessly and has never been broken since its inception in 2009. It is more and more robust year after year as measured by its 'hash rate'. We note that miners' current geographical concentration in China introduces a small but non-zero risk of disruption to the validation process. The bitcoin community can probably mitigate this risk. It is also transitory: miners in North America or Europe benefit from a structural financing advantage to procure a larger share of the new mining hardware (ASICs), eventually leading to a geographical rebalance.

“Not your keys, not your coins”

Even if the protocol itself is robust and resistant to attacks, the other weak point is the investor and how he secures ownership of his bitcoins. More specifically, one has to secure the private key (a 256-bit number), which is the 'proof of ownership' of those bitcoins.

It is essential not to leave bitcoins on the exchanges (in case the exchanges are hacked, unavailable, or go bankrupt) and to use 'cold storage', i.e. secure USB keys containing and protecting the private keys. Furthermore, these USB keys must not be lost and placed in a physically secure location, i.e. not at risk of theft, fire, or inundation.

In summary, the tools are now widely available, and the responsibility to use them in the right way firmly sits with investors.

In summary of the point 5 section, the Bitcoin protocol is robust (by far the most robust of all 'crypto-assets') and there are convenient tools for investors to secure their bitcoins. To be complete, one needs to keep in mind a temporary small but non-zero risk coming from the geographical concentration of validation computing power in China.

Wrap-up

To cut through the hype and noise, we highlighted five points when considering whether or not to invest in bitcoin as part of a diversified portfolio.

- The macroeconomic environment is favourable to scarce assets.

- Bitcoin is programmed to be in limited supply and can be seen as 'digital gold'.

- Bitcoin has a non-zero value. The token is part of a process with a practical utility as a wealth/money transfer system.

- There is increasing demand coming from new investors i.e. institutional investors. This year is also expected to be a bull year for bitcoin.

- The Bitcoin protocol is secure albeit with a small risk due to transitory computing power concentration in China.

In summary, bitcoin appears out of the kindergarten of assets and has moved into high school. Like every teenager, it has busts of exuberance and moments of 'Blues' with fairly high price volatility. However, with limited supply and rising demand on the backdrop of a favourable macro-economic environment, it is certainly worth looking into.

Similarly to any other investment, the reader will need to rationally assess for himself the risk and potential reward. Once again, emotions will not be good advice!

A subsequent article will look at indicators painting a picture of bitcoin's situation at a given point in time. This can help identify if price levels are healthy, and therefore entry and exit points. Contrary to the traditional opaque financial world, the Bitcoin blockchain is public. It can therefore be analysed to extract information such as the behaviour of long-term bitcoin holders.