Does bitcoin investing make sense? Exploring the high-level case (part 1)

March 26, 2021

You are probably tired of hearing about bitcoin and, you will most likely hear more about it this year. There is indeed no shortage of adverts for 'get rich quick' schemes. YouTubers right out of puberty are also labouring the topic, hoping to monetize their influencing skills.

This activity raises a question for the 'reasonable investor': what are the key points to consider to make an informed opinion?

Five key points

- Macroeconomic backdrop: there is brutal and considerable monetary inflation worldwide, i.e. a vast increase of newly created money in people's pockets. As a result, there are suddenly more Dollars, Euros or Pounds chasing the same amount of goods (e.g. food) and raw materials (e.g. copper), assets (e.g. stocks), and stores of value (e.g. gold, art, jewellery). This imbalance tends to depreciate these currencies and generate inflationary tendencies.

- Limited supply: when it comes to stores of value, one can make a case for bitcoin as 'digital gold' and therefore as its modern-day substitute or complement.

- Intrinsic value: Bitcoin (the protocol) has an intrinsic value as a means of wealth/money transfer, and subsequently, so does bitcoin as an integral part of this protocol.

- Increasing demand: Bitcoin is gaining traction amongst institutional investors, leading to a rise in demand. Furthermore, as a result of the way the bitcoin supply is pre-programmed, there is a four-year price pattern expected to peak later this year.

- Strong security: the Bitcoin protocol has not been broken once since its inception in 2009. Besides, there are now reasonably robust ways to store the 'proof of ownership' of your bitcoins securely.

This post covers points 1 and 2, and the follow-up post covers points 3 to 5. We will stay at a high level in both articles. Subsequent write-ups will cover each of these five points in more depth.

Jump straight to:

Semantics

Let us first distinguish between Bitcoin (uppercase 'B') and bitcoin (lowercase 'b'). Bitcoin typically labels the protocol, the payment network and the community. In contrast, the coin/medium of payment is generally written as bitcoin.

Point 1 - macroeconomic backdrop: monetary inflation

As a response to the Covid crisis, major economies are printing money on a scale not seen in recent history, resulting in a significant increase of money in people's pockets (called 'broad money supply').

Visualizing the money increase

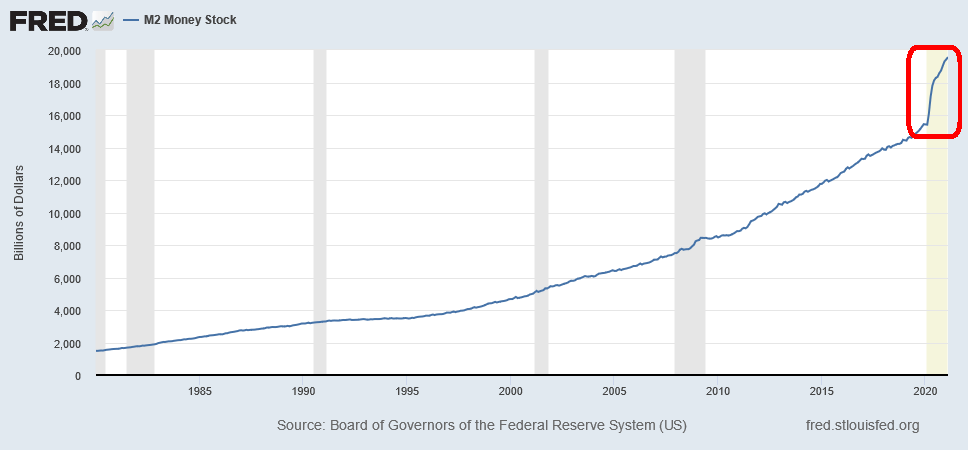

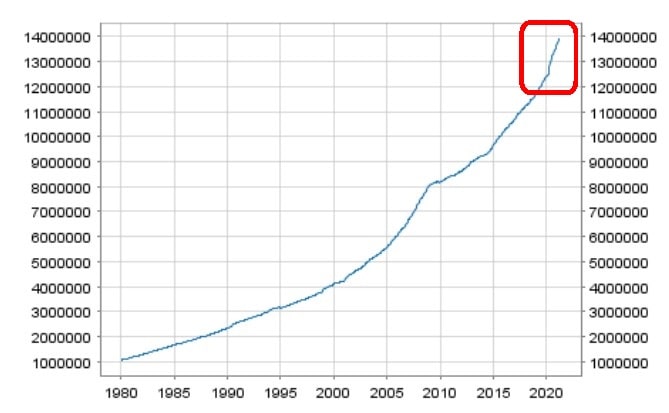

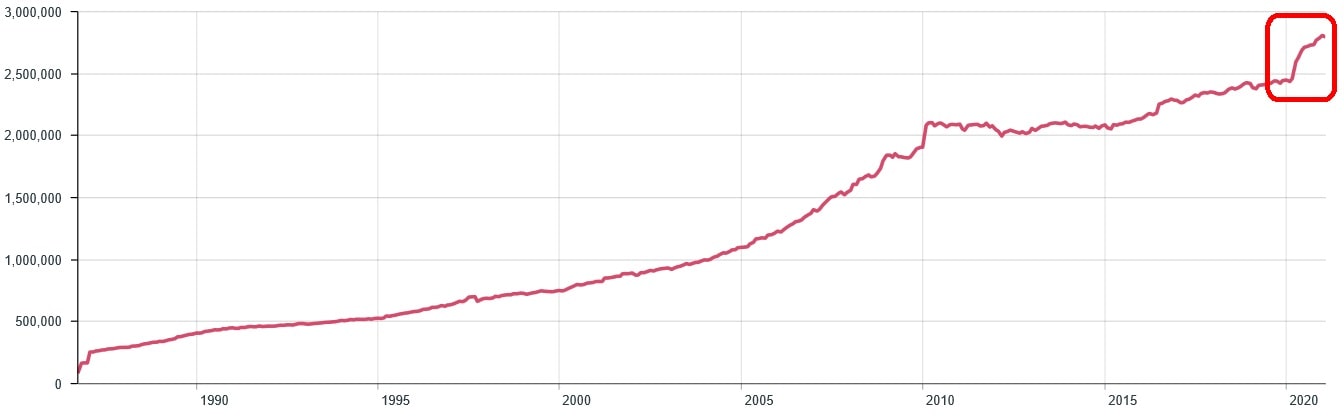

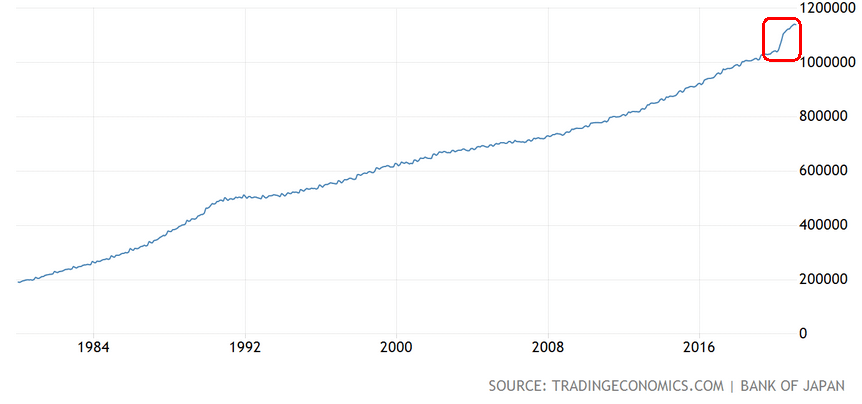

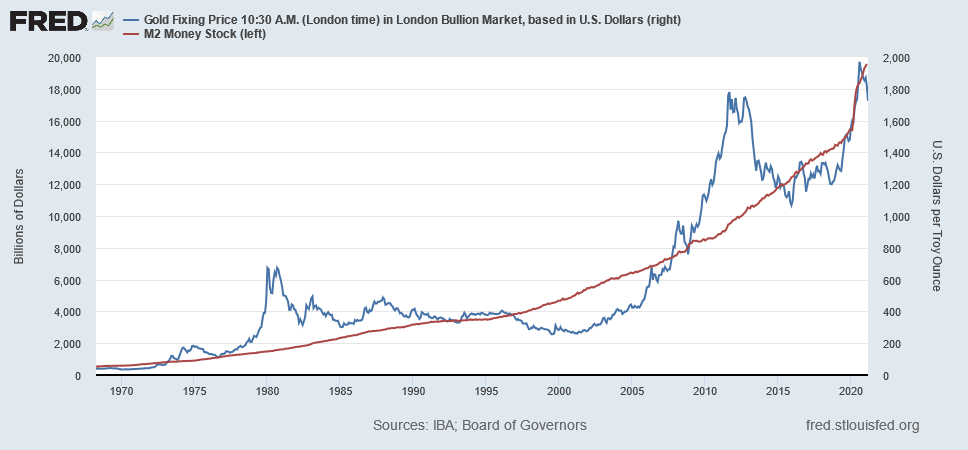

The charts below use 'M2 money supply', which represents this 'broad money supply'. M2 is defined as cash, checking deposits, savings deposits, money market securities, mutual funds, and other time deposits (such as certificate of deposit). In short, M2 represents money (e.g. cash) or near-money quickly convertible to cash (e.g. savings) circulating in the economy at a given point in time.

Red circles on the chart highlight the sudden acceleration in money supply as a response to the Covid pandemic.

M2 ‘money supply’ for the USA (1980 to 2021): Vertical scale in USD billions, i.e. most recent M2 figure = USD 19.6 Trillion

Click here for a larger image (pop-up window)

M2 ‘money supply’ for the Eurozone since 1980 (Source: European Central Bank):

Vertical scale in EUR millions, i.e. most recent M2 figure = EUR 13.9 Trillion

Click here for a larger image (pop-up window)

M2 ‘money supply’ for the UK since 1980 (Source: Bank of England):

Vertical scale in GBP millions, i.e. most recent M2 figure = GBP 2.8 Trillion

Click here for a larger image (pop-up window)

M2 ‘money supply’ for Japan since 1980: Vertical scale in Yen Billions, i.e. most recent M2 figure = Yen 1139.7 Trillion

Click here for a larger image (pop-up window)

The impact of a large money supply increase on scarce assets

These extra Dollars, Euros, or Pounds (called 'fiat' currencies) are chasing a quantity of goods, assets, and stores of value that have not increased as fast or have not increased at all. As a result, one can expect asset price inflation (e.g. stocks) and/or consumer price and raw materials inflation (e.g. bread, wheat). It is too early to tell which one of the two (assets and/or consumer goods & raw materials) will be the most impacted.

However, assets with inherent scarcity such as gold (or bitcoin, as we shall see later) will tend to do well when there is an unlimited supply of new fiat currencies printed at will. In other words, fiat currencies will tend to lose value and depreciate relative to absolute stores of value such as gold.

One can see on the chart below that gold prices in US$ tend to increase along with the US$ M2 money supply albeit with some volatility.

Red, left scale: M2 money ; Blue, right scale: gold price in US$ ; 1968 to 2021.

Click here for a larger image (pop-up window)

A practical example: house prices priced in US dollar and in gold

To better understand what money printing means, we can take an example and use house prices.

Many US residents suddenly received a US$1400 check from the US government ('helicopter money'). It can be used to bid up the price of a house and ultimately buy it. However, the absolute value of this house has not changed in that one single day. Priced in gold and uniquely in gold, its gold-based price would be the same from one day to the next since nothing has changed. Indeed, the amount of gold available 'above the ground' has not changed. People having gold and those not having gold have not changed. The number of houses available has not changed. Nothing has changed other than the sudden arrival of this check and the newly created US$ printed on it.

In summary, while people have more dollars in their pockets and, no doubt, feel good about it, each dollar is now worth less than before when compared to a stable reference point. The currency has actually depreciated in absolute terms.

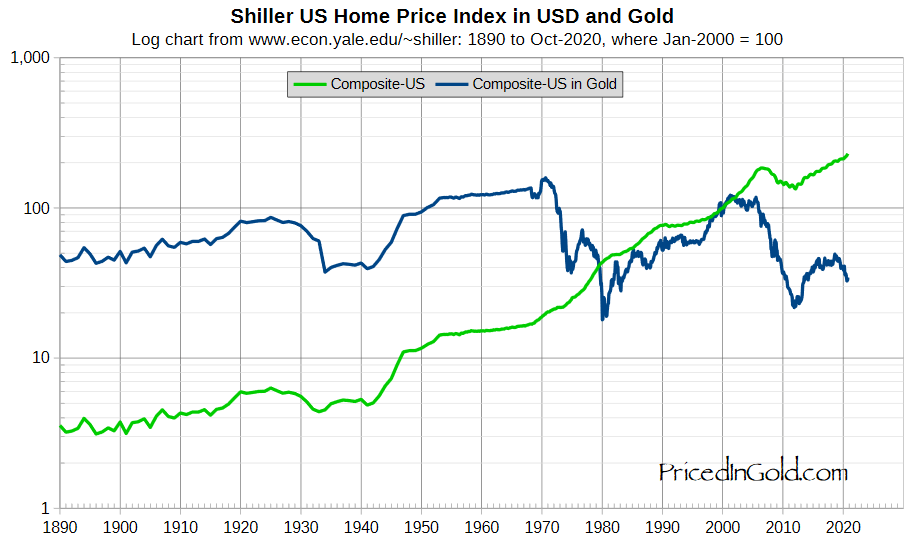

We will see that while house prices consistently rise over time when priced in USD, GBP, or EUR, they are broadly flat when priced in gold—albeit with some volatility.

The first chart uses the 'Case-Shiller Home Price Index' and goes back 130 years. It shows that, over the long term, house prices remain in a price band when expressed in gold. By contrast, house prices consistently go up when priced in US$. Today, a house costs the same amount of gold as it was at the end of the 19th century or in the late 1930s.

NB: The sharp drop from 1971 shows the impact of the end of the convertibility of US$ into gold. The US$ quickly depreciated against gold till 1980. Consequently, and while house prices kept going up when priced in US$, they lost significant value when priced in gold. From 2007 to 2012, house prices fell both in US$ and when priced in gold. Following years of speculation, houses were overpriced in US$ when entering the great financial crisis and the US$ price subsequently corrected. Besides, and as a response to the great financial crisis, the money supply was increased post-2008 resulting in the US$ losing value against gold. Compounding the two effects, house prices, when priced in gold, collapsed.

Click here for a larger image (pop-up window)

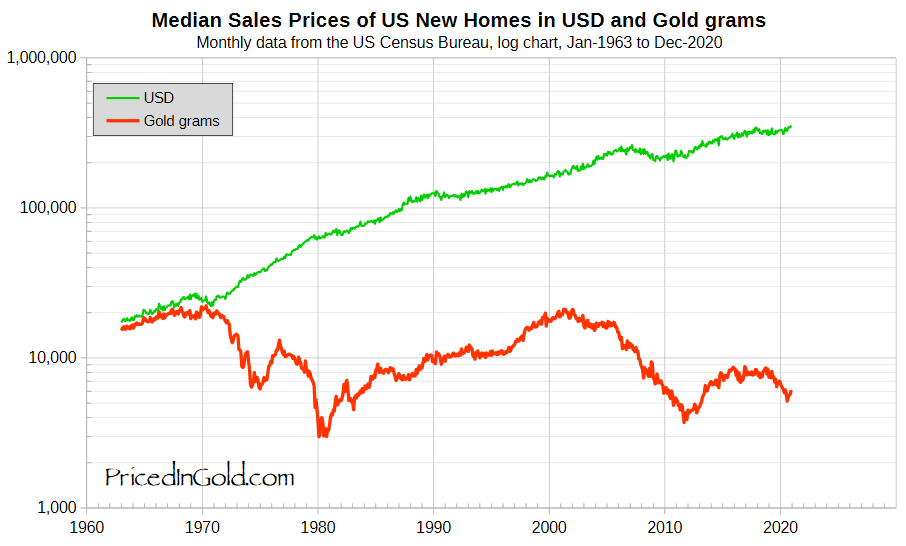

The second chart focuses on the last 60 years and uses the 'median sales price of new homes' plotted both in US$ and in gold. Once more, we see that the median sale price is broadly stable when priced in gold. Note that when expressed in US$ terms, these new home prices keep on rising!

Click here for a larger image (pop-up window)

The attentive reader would have noticed that the price curves for new homes in US$ and gold are quasi identical from the start of the chart till 1971. Indeed, the dollar was convertible and pegged to gold until Nixon temporarily suspended the dollar-gold convertibility in 1971. As one should know, the word 'temporary' in politics has a different meaning than everywhere else. Something also valid for 'temporary' taxes.

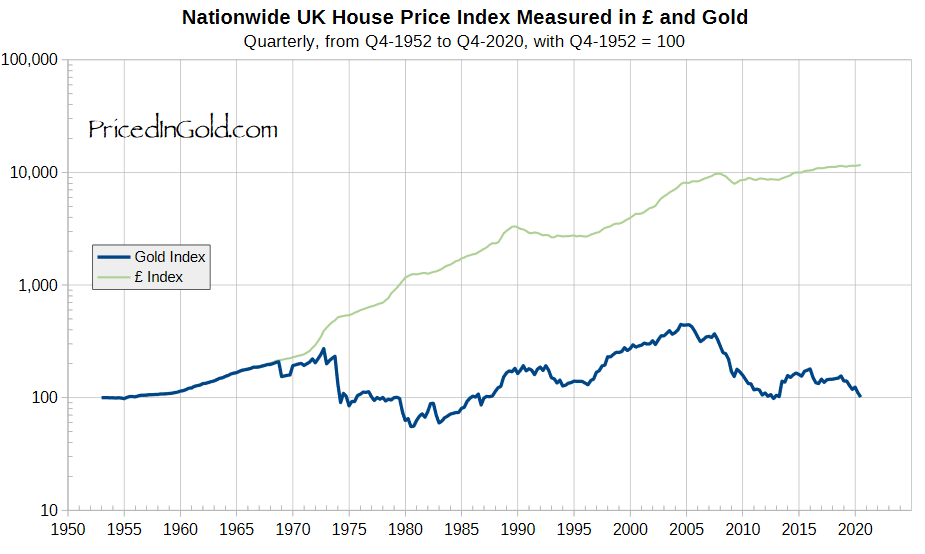

Non-US readers might be misguided in thinking that there are immune to this issue. Sadly, this is not the case.

The chart below shows house prices in the United Kingdom since the 1950s. The conclusion is precisely the same, i.e. that houses prices are broadly stable over time when priced in gold even if they go up in GBP. When expressed in gold, today's price is the same as in 1955, 1977, 1986, or 2013.

Click here for a larger image (pop-up window)

French readers are equally impacted as this post demonstrates (in French). It shows—once again—that over the last 30 years, real estate prices in Paris are stable when priced in gold, whereas they constantly go up when priced in EUR.

In summary, house prices show the impact of monetary inflation, i.e. the creation of a large quantity of new Euros, Pounds, or Dollars out of thin air but not matched by an equal increase in assets or goods. The previous examples also seem to lead to a conclusion beyond this article's purpose on bitcoin: real estate as an aggregate appears a good store of value over the very long term (several decades).

Point 2 - bitcoin as 'digital' gold

Gold and bitcoin have common characteristics. They both have a limited supply, and one needs to make more and more effort over time to 'mine' and obtain a given quantity of new fresh gold or bitcoin. This characteristic ensures rarity by opposition to the billions of new Euros, Pounds or Dollars printed at (political) will.

On the other side (the 'demand' side), both gold and bitcoin are mostly—but not only—driven by a form of human consensus whereby they are both perceived as good fungible stores of value.

A) Limited supply

The supply of gold is restricted and requires significant effort and cost to extract from the ground. It is getting harder and harder to find and extract over time. The new supply is estimated to be about 2% per year.

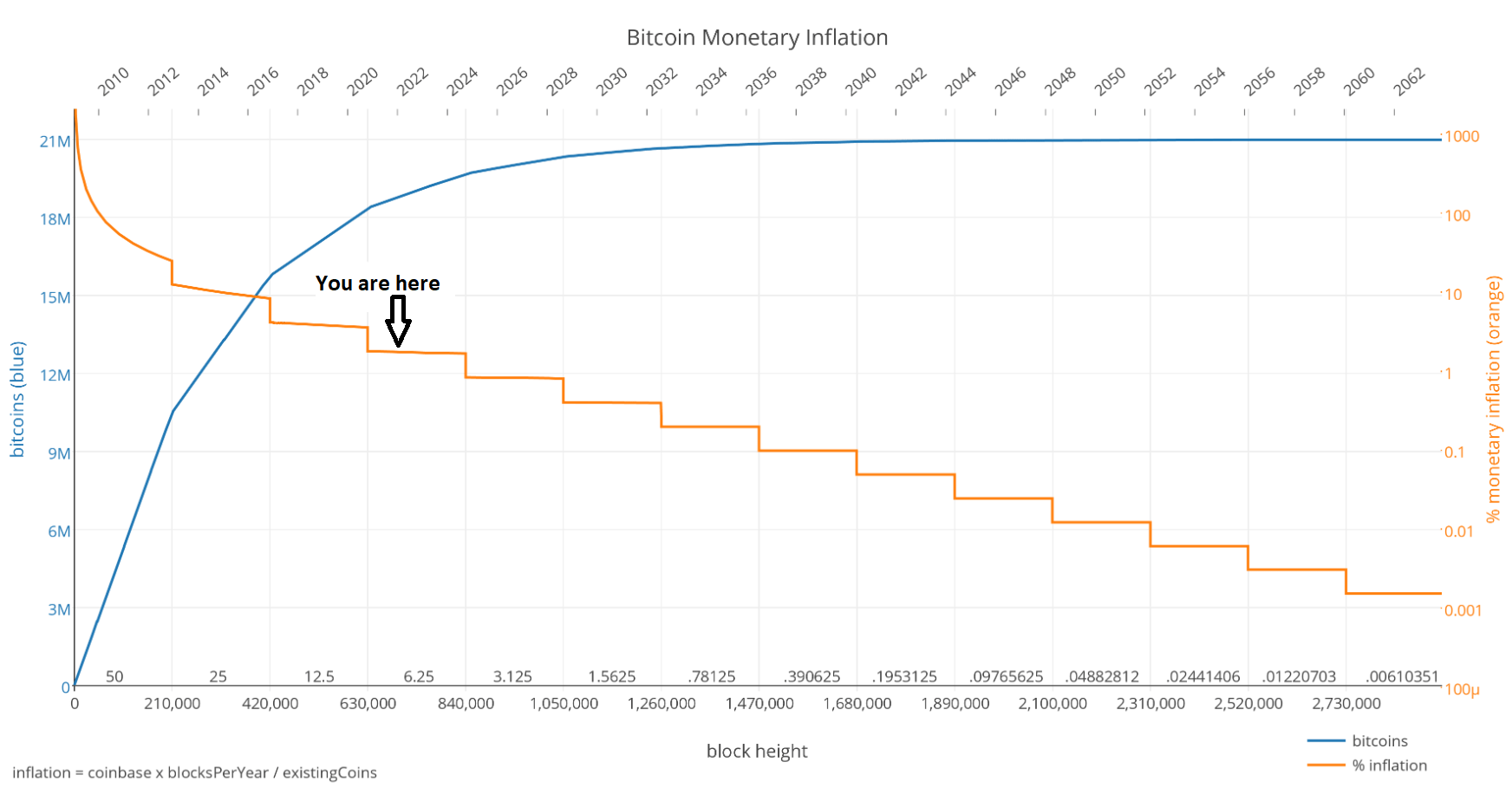

Similarly, the supply of bitcoin is limited. It is capped programmatically at 21 million. 'Mining' it (i.e. validating transactions, thereby getting rewarded with brand new freshly created bitcoins) requires expensive hardware and electricity to solve the mathematical problem attached to validating a block of transactions. Like gold, it gets more challenging over time to 'mine' and to obtain new freshly-minted bitcoins as the reward is pre-programmed to reduce over time. Specifically, every 210,000 blocks i.e. about every four years, the bitcoin reward for being the first to solve the mathematical problem and successfully mining a new block is divided by two. This means that—all other things being equal—a 'miner' needs to deploy twice as much computing power (energy, hardware, etc) to get the same revenues as the four years prior.

Click here for a larger image (pop-up window)

In other words, a miner needs to find a new profitability point that is exponentially harder i.e. a miner doubling the hardware and associated costs every four years faces exponential costs. In addition, it is worth mentioning that even within a four-year period, the difficulty of the mathematical problem self-adjusts every 2,016 blocks (i.e. ~every 2 weeks). So, there is a constant arms-race between miners to continuously upgrade the hardware while reducing mining costs.

B) Demand-side: mostly a store of value with limited business use

Gold has some industrial use but only for about ~10% of its demand. The rest of the demand is as a store of wealth (e.g. jewellery, bullion) by long-term historical consensus amongst humans.

Similarly, there is a demand for using the Bitcoin protocol as a peer-to-peer electronic payment and wealth/money transfer system. The rest of the bitcoin demand is as a store of value that is gaining consensus amongst humans. For the first ten years of bitcoin, the consensus was mostly between a subsection of retail investors, but it is now gaining traction with institutional investors (point 4 in the next post).

In summary of this point 2 section, bitcoin can indeed be seen as 'digital gold'. Both gold and bitcoin have a limited supply—in sharp contrast with the vast monetary inflation we witness today. Besides, there is consensus amongst humans that they are good stores of value. For gold, it is a well-established historical consensus, whereas for bitcoin, it is a growing nascent consensus.

Wrap-up

We have seen that, in the current context of massive monetary inflation, bitcoin presents the characteristic of scarcity. As demonstrated by historical gold prices, an asset with limited supply tends to do well against fiat currencies (e.g. US$, GBP, EUR) created at will in an unlimited way.

The second part of this article will look at bitcoin's inherent value in light of increasing demand. It will also look at the security topic.

The combination of these two posts will hopefully paint a high-level picture and allow the 'reasonable investor' to start doing his own research while keeping a cool head and focusing on what matters.