Beyond Covid and GIPP: profit pools and strategic implications for the UK motor insurance market

10 Aug 2022

Introduction

The unique combination of one unplanned event (covid) and one planned event (the implementation of the General Insurance Pricing Practices) raises fundamental questions for the UK motor industry:

-

What happened to the industry profit pools and margins during covid and the initial GIPP implementation?

-

What will happen to the margins and profit pools going forward? Will the industry ever recover from the GIPP implementation and how long will it take?

-

What does this mean from an industry strategic perspective?

In this analysis, we will look at the multiple revenue streams and profit pools of the motor insurance market i.e. underwriting profit, as well as profits from instalments, add-ons/cross-sells, and fees (administrative fees, change fees, etc).

We will however purposely leave aside income and profit from investments. This is because it depends on a number of macro-economic factors beyond the point of this article (e.g. interest rates). It also depends on the organisation and decisions of each individual player: investment portfolio mix, centralized vs. decentralized investment pool across business lines, etc. What can be said is that large, multi-lines, and/or international players can generate a large additional income from investments while small, focused or local UK players are at a disadvantage.

Key learnings from the profit pool analysis articulated below.

1) Pre-covid and pre-GIPP, the main profitability driver for the UK Motor insurance market was not underwriting profit. It was profit from 'other income'.

-

Instalments, add-ons, fees, cross-selling, etc, which represented circa two-thirds of total profit.

2) Profit from 'other income' (instalments, fees, etc) will save the day going forward post-Covid and post-GIPP.

-

We can expect a large underwriting loss in 2022 and a more moderate one in 2023.

-

But profit from 'other income' will keep insurers afloat - particularly in 2022.

3) The size of the profit pool arising from instalments may well attract the attention of the FCA.

-

The major source of profit in 2019 (~40%) and this pattern will be exacerbated at least till 2025 inclusive.

-

As inflation bites from 2022 onwards, consumers are more likely to pay by instalment. With politicians looking for ways to demonstrate they are helping consumers, the FCA might look into instalment charges and would probably find them excessive.

4) The GIPP and covid effects are transitory with 2025 total profit back to 2019 level.

-

While underwriting profit is unlikely to fully recover from GIPP implementation, the growth in profit from 'other income' (i.e. instalments, fees, etc) will fill the gap.

-

The cumulative loss over the period 2022 to 2025 relative to 2019 profit is ~£3.2bn. This is more or less the middle of the range expected by the FCA over ten years for motor insurance alone. It just so happens that it will not take 10 years to materialise.

Recommendations and strategic implications for the UK motor insurance market - industry players should:

1) Deliver quick tactical improvements:

- Explore, prioritize and deliver optimizations of current processes or capabilities.

2) Make every effort to support the recovery of underwriting profit while respecting the spirit of GIPP e.g.

-

Expand footprint where feasible: in the market or cross-selling on own customer base (e.g offer motor insurance to home insurance customers).

-

Segment customers with much finer granularity for an optimized offering ('the right tiered products', 'the right add-ons', etc). This should also help with Price Comparison Websites' competitiveness.

-

Improve underwriting and risk: develop differential segmental expertise and explore new technology e.g. Machine Learning for faster and more accurate risk pricing.

3) Focus on growing alternative sources of income

- Be wary of reliance on instalment income as it might come under review by the FCA. Focus instead on add-ons as well as the 'convenience/easiness' of the customer purchase journey. E.g. "one-click £3/month extra for car key cover". Use enhanced data capabilities for Amazon-type suggestions on an app on customers' phones: "customers like you added x or y. One click to proceed".

4) Identify and jump early into the next waves of growth

- e.g. EV, connected cars, etc. Consider partnering and or focused M&As to jump-start the capabilities.

5) Control or reduce costs:

- With profit under serious pressure in the next 3 years, shareholders are likely to demand a degree of cost control.

6) Consider strategic M&A for smaller players

- Assess shareholder appetite for an M&A to gain scale.

2020 - 2022: a look back at two pivotal years in the UK motor insurance industry

From 2019 to 2022, the UK motor insurance market went through two major and consecutive disruptive events: the covid crisis and the implementation of the General Insurance Pricing Practices (GIPP) in Jan 2022.

1) Covid generated a large and unexpected market disruption:

-

In 2020, people had to stay home and could no longer drive. Therefore, accidents and subsequent claims dropped, leading to excess profitability for insurers.

-

In 2021, a year still rich with "stay at home" orders, insurers adjusted premiums downwards to match the lower claims, with profitability pointing back to more normal levels (albeit still higher).

-

In 2022, people went back on the road and the number of accidents returned to normal. However, inflation impacted the cost of repair meaning that the GBP amount of claims exceeded the 2019 levels. As a result and with premiums still relatively low at the start of the year, the profitability of market players collapsed. To further murky the waters, the General Insurance Pricing Practices (GIPP) was introduced as planned in Jan 2022.

2) GIPP is meant to save money for consumers by preventing insurers to price-walk them.

Price walking is a practice whereby longstanding customers of a service provider are charged higher prices for the same services compared to customers that have just switched to that provider. The FCA rightfully expected this regulation to decrease premiums for existing customers and increase premiums for new customers (with the level of increase moderated by competition intensity between market actors).

Overall, the FCA expects a decrease in the average premium (i.e. new and existing business combined) with consumers to collectively save somewhere between £4.2bn to £11.2bn over 10 years (from 2022 to 2031). This range applies to both motor and home insurance combined (with motor insurance savings expected to be the smaller portion of savings vs. home insurance). This range is the result of the FCA running two scenarios simulating two levels of competition intensity between market players. Readers can refer to this document (pages 38 to 40).

How do UK motor insurers make money? What are their income streams?

1) Underwriting profit

2) Instalment income, i.e. the extra charge to consumers paying their premium by instalments

3) Extra revenues from add-ons/cross-sells

4) Fees i.e. administrative fees, change fees, etc

5) Additional revenues from billing the at-fault insurer for post-accident and repair costs in case of a no-fault accident

5) Investment income (which we exclude from this analysis as explained above)

Market underwriting profits 2019 - 2025

Historical underwriting profits (2019 to 2021)

Using a report from Barclays (its data is sourced from the annual reports of market players), we get the COmbined Ratio (COR) and the Gross Written Premium (GWP) for most market actors from 2019 to 2021. This allows us to produce an estimate of the market underwriting profit (charted below).

Future underwriting profits (2022 to 2025)

To estimate future underwriting profits from 2022 to 2025, we need to estimate each year:

- The number of policies sold and the average premium. This will give us an estimate of the GWP.

- The COR

We can then vary assumptions for sensitivity analysis.

1) Forecasting GWP.

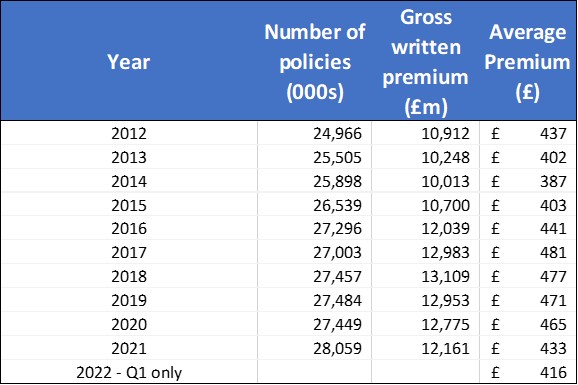

Using ABI data, we see that the number of policies sold increases by about 0.9% yearly (CAGR 2015-2021). As a starting point assumption, we can carry this growth forward to future years. Needless to say, it does not account for the behavioural impact of the highest inflation in decades (e.g. some people might choose to give up their cars to save money).

Regarding the average premium for 2022 to 2025, we first need to build an understanding of the expected market pricing dynamic.

At high level, the logic is as follows:

-

Claims inflation is driving premiums up again in 2022. However, this rise should be moderate at first (i.e. in 2022 and possibly 2023) as some players have their coffers full from unexpected excess profits from the covid period in 2020 and 2021 (see chart above: over this period, there are ~£1.3bn of excess underwriting profits when compared to 2019 levels). This means that some players are attempting a loss-leader strategy to gain market share thereby increasing overall competition and limiting average premium increase across the market.

-

When these reserves run out, the downward pressure on price will reduce, and we can then expect a steeper average premium increase to catch up with claims inflation.

-

In addition, we need to factor in the GIPP effect and the associated industry response. Per the FCA models, it should further reduce market profits by £1.5bn to £4bn over 10 years for motor insurance only. However, this market is rational with investors exerting pressure to recover prior margin levels and no obvious player able to subsidize a loss-leader approach. In effect, the industry is already responding and trying to claw back the lost margins in the form of tiered products ("basic" vs "gold" offering), additional cross-selling efforts, etc.

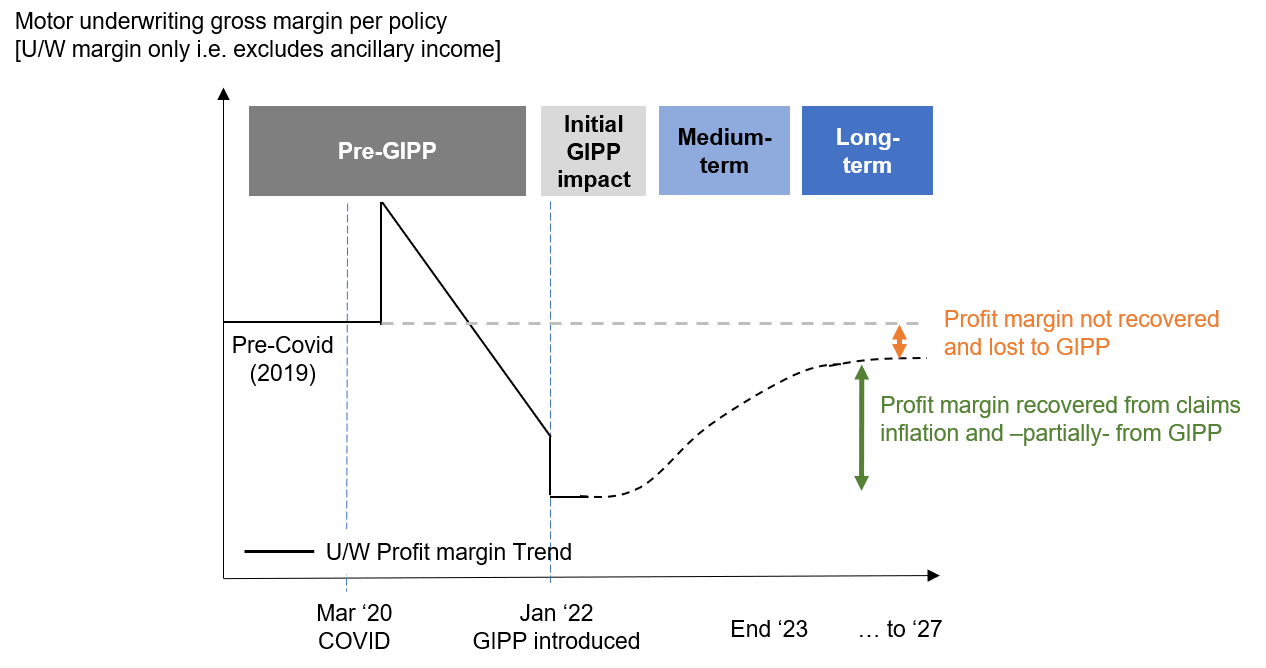

We can therefore expect a profit margin curve looking like the chart below:

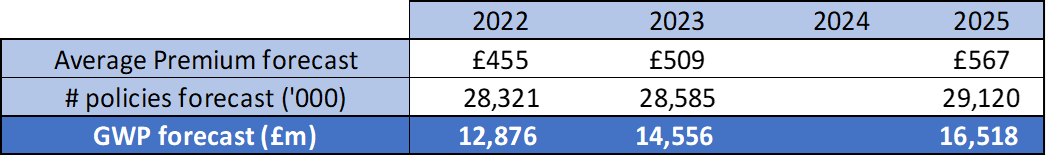

Using the above curve and its underlying model, we can now produce an estimate of average premiums for the years ahead. Interestingly, we note that EY produced a report leading to a similar outcome in terms of the shape of the average premium rise in 2022 and 2023: they forecast a price rise of 2% YoY in 2022 and 18% YoY in 2023. However, while I agree with an increase in 2022 lower than 2023, I think their numbers are too extreme for both years. I would therefore prefer to plug in increases of 5% YoY in 2022 and 12% YoY in 2023. For the longer term, e.g. the 2025 average premium, we assume as per the chart above a quasi -but not full- recovery of profit margins (meaning premiums will go up enough to offset claims inflation over the period and most of the GIPP effect).

With the average premiums and the number of policies sold, we can now compute estimates of the GWP for the years ahead. An example is provided in the table below.

2) Forecasting future CORs

To provide a reference point, motor insurance CORs in the 2010s were typically in the 95% to 109% range depending on the year.

We can expect 2022 to be a tough underwriting year for insurers. In line with the logic and the margin curve detailed above, they started the year with premiums way too low for the level of claims inflation they are facing (both due to the number of accidents going back to the pre-covid normal and to the inflating cost of repairs). So, the COR will definitely be more than 100%. In the paper mentioned above, EY puts it at 114%. I would personally put it lower i.e. in the 105% to 115% range.

In 2023, we would expect the industry to react, leading to a lower COR. Premiums will continue to go up and insurers will make efforts to reduce their costs/expenses under pressure from shareholders. It is also possible that policy terms may be adjusted with more exclusions leading to less incurred losses. All the factors combined should lead to a lower (better) COR. Once again, the EY report is fairly pessimistic at 111%. I would propose a range of 99% to 108% i.e. slightly worse than historical 2010s CORs.

Market profits from 'other income' 2019 - 2025: instalments, add-ons, fees, etc

Historical profits from 'other income' (2019 to 2021)

I reviewed recent annual reports from a number of players (Admiral, DLG, Hastings, Sabre, eSure). They collectively represent ~50% of market GWP. This review leads to several interesting conclusions:

-

Profit arising from 'other income' (instalment, fees, etc) is broadly proportional to the GWP

-

The conversion factor from GWP to profit from 'other income' is very stable over time on a per company basis

-

It is also relatively similar from one player to another i.e. in the high single-digit low double-digit range (with the exception of Sabre)

-

'other income' can be split 60/40 between instalments vs {add-ons, cross-sell, fees, etc}. It is consistent across time and across the companies reviewed with the notable exception of Admiral (which is 30%/70%)

The chart below summarizes the outcome and leads to a reasonable, stable and consistent ~10% factor allowing to convert market annual GWP into annual market profit from 'other income'.

For example, if the motor insurance market GWP is £100m, profit from 'other income' should be ~£10m.

Click here for a larger image (pop-up window)

Future profits from 'other income' (2022 to 2025)

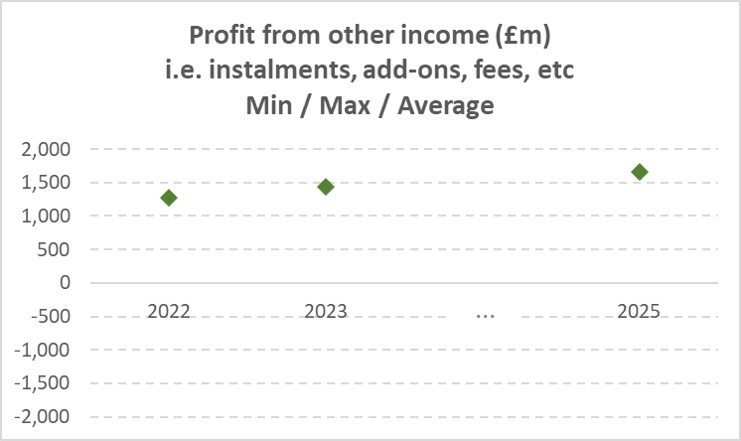

Because of the stability over time of the aforementioned conversion factor (GWP -> profit from 'other income'), we can safely extrapolate future profitability from 'other income' from future GWP.

-

As mentioned previously, GWP grows steadily at about 0.93% per annum, so we can use 0.9% to 0.96% as a range.

-

We then apply our conversion factor - again using a range of, say, 9% to 11%- to get profit from 'other income' from the GWP.

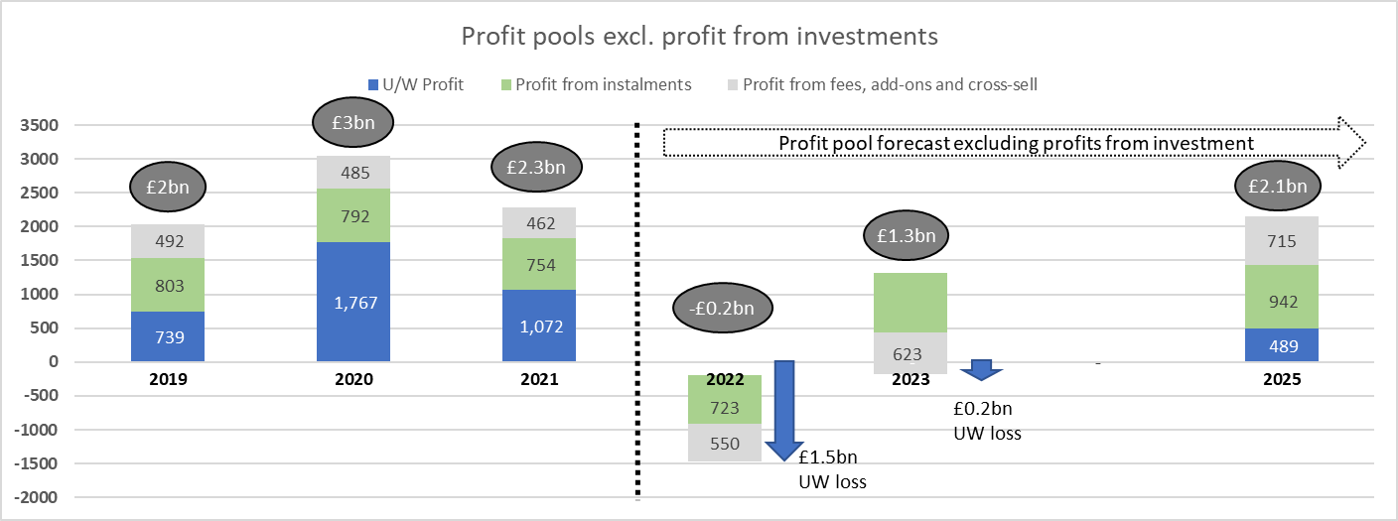

Putting it all together: market profit pools 2019 - 2025

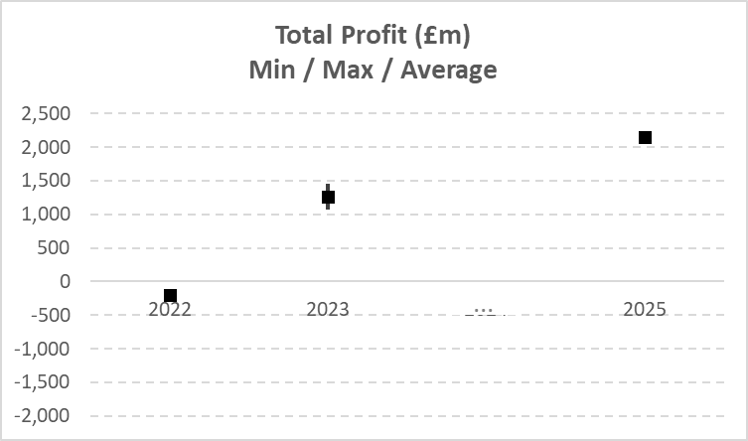

1) Once the model is built, we run it 1000s of times. For each iteration, it picks at random an input from the chosen range. Below is an example of a reasonable set of ranges.

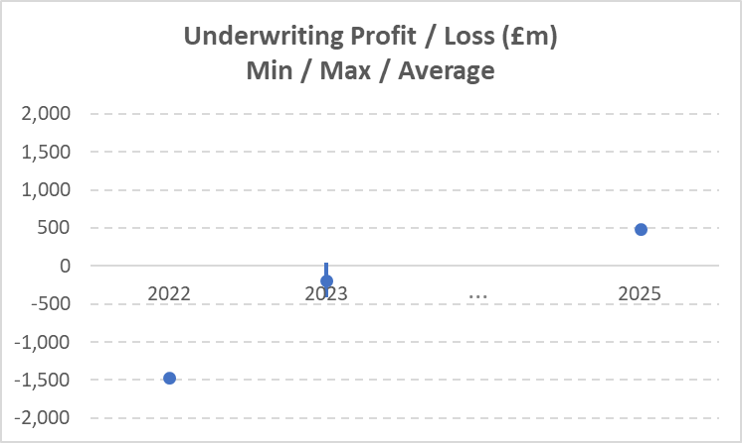

2) The model generates a range of outcomes (min/max/average) with the resulting charts presented below. As a reminder, 'Total Profit = Underwriting Profit + Profit from 'other income' i.e. from instalments, add-ons, cross-sales, fees, etc'

3) We also plot a breakdown of the profit pools for the average values above. And compare it with the historical profit pools split.

Click here for a larger image (pop-up window)

Key learnings from the profit pool approach.

Note/reminder: this analysis excludes profit from investments. This item depends on a number of macro-economic factors beyond the point of this article (e.g. interest rates). It also depends on the organisation and decisions of each individual player: investment portfolio mix, centralized vs. decentralized investment pool across business lines, etc. What can be said is that large, multi-lines, and/or international players can generate a large additional income from investments while small, focused or local UK players are at a disadvantage.

1) Pre-covid and pre-GIPP, the main profitability driver for the UK Motor insurance market was not underwriting profit. It was profit from 'other income' i.e. from instalments, add-ons, fees, cross-selling, etc. In other words, the intensity of the competition limited profits arising from underwriting and risk-assessment skills and pushed insurers to look for other sources of income - which eventually became the main sources of profit.

-

Profit from 'other income' represented about 2/3rd of total profit. Within profit from 'other income', 2/3rd was profit from instalments. In other words, customers paying by instalment are a key and stable contribution to the profitability of the industry.

-

Profit from 'other income' is an anchor of stability while underwriting profit may vary considerably YoY. 'Other income' is also highly predictable. Indeed, profit from 'other income' is directly proportional to GWP which -at the aggregated market level- slowly but surely grows at ~0.9% pa.

2) Profit from 'other income' (instalments, fees, etc) will save the day going forward post-Covid and post-GIPP.

-

We can expect a large underwriting loss in 2022 and a more moderate one in 2023.

-

But profit from 'other income' will keep insurers afloat - particularly in 2022.

3) The size of the profit pool arising from instalments may well attract the attention of the FCA.

-

It was the major source of profit in 2019 (~40%) and this pattern will be exacerbated at least till 2025 inclusive.

-

As inflation bites from 2022 onwards, consumers are more likely to pay by instalment. With politicians looking for ways to demonstrate they are helping consumers, the FCA might look into instalment charges and would probably find them excessive.

4) The GIPP and covid effects are transitory with 2025 total profit back to 2019 level.

-

While underwriting profit is unlikely to fully recover from GIPP implementation, the growth in profit from 'other income' (i.e. instalments, fees, etc) will fill the gap.

-

On the model above, the cumulative loss over the period 2022 to 2025 relative to 2019 profit is ~£3.2bn. This is more or less the middle of the range expected by the FCA over ten years for motor insurance alone. It just so happens that it will not take 10 years to materialise.

Recommendations and strategic implications for the UK motor insurance market - industry players should:

1) Deliver quick tactical improvements:

Explore, prioritize and deliver optimizations of current processes or capabilities.

2) Make every effort to support the recovery of underwriting profit while respecting the spirit of GIPP e.g.

-

Expand footprint where feasible: footprint in the market or cross-selling on own customer base (e.g offer motor insurance to home insurance customers).

-

Segment customers with much finer granularity for an optimized offering ('the right tiered products', 'the right add-ons', etc). This should also help with Price Comparison Websites' competitiveness.

-

Improve underwriting and risk: develop differential segmental expertise and explore new technology e.g. Machine Learning for faster and more accurate risk pricing.

3) Focus on growing alternative sources of income

Be wary of reliance on instalment income as it might come under review by the FCA. Focus instead on add-ons as well as the 'convenience/easiness' of the customer purchase journey. E.g. "one-click £3/month extra for car key cover". Use enhanced data capabilities for Amazon-type suggestions on an app on customers' phones: "customers like you added x or y. One click to proceed".

4) Innovation:

Identify and jump early into the next waves of growth e.g. EV, connected cars, etc. Consider partnering and or focused M&As to jump-start the capabilities.

5) Control or reduce costs:

With profit under serious pressure in the next 3 years, shareholders are likely to demand a degree of cost control.

6) Strategic M&A for smaller players:

Assess shareholder appetite for an M&A to gain scale.