The 'average' investor obtains catastrophic long-term returns

18 March 2021

Key take-outs

- The average investor exhibits poor long-term returns. Emotions drive this outcome: fear of missing out ('FOMO') and fear of losing money.

- A simple and methodical investment process eliminates emotions. Therefore, a methodical process allows to capture the full return potential of a given asset class.

- In equities, the simplest methodical approach is to invest in a broad index ETF and reinvest dividends.

Background

The ‘average’ investor exhibits an extremely poor long-term track record.

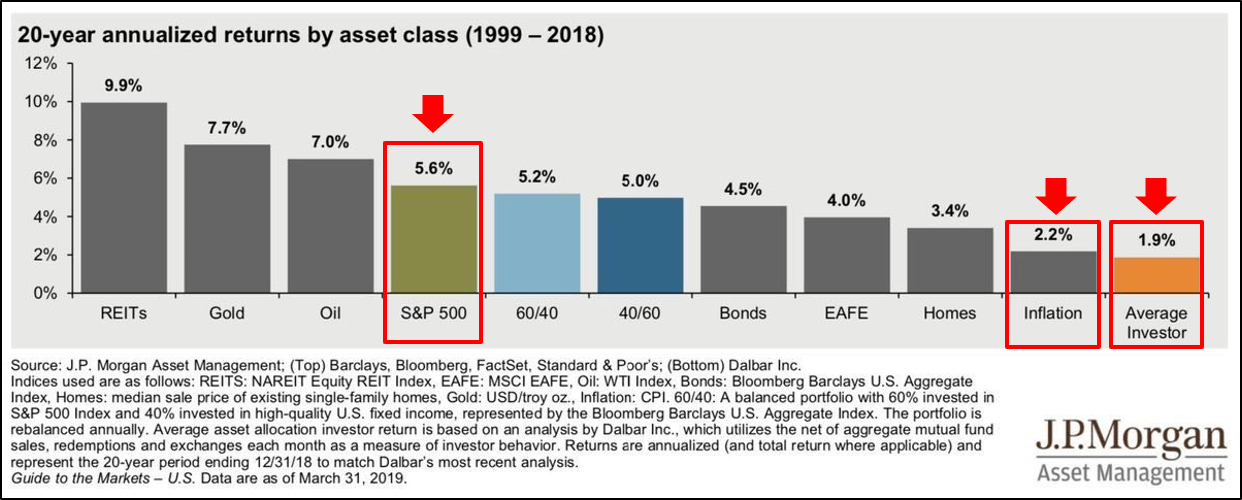

For example, the chart below shows that over the 20-year period from 1999 to 2018, the average investor did not beat inflation. This means that his purchasing power actually diminished over this period i.e. he “lost money” in real terms.

Click here for a larger image (pop-up window)

In the same example, the average investor also trails the performance of every single asset class over the period e.g. real estate, gold, bonds, the SP500 (as a proxy to the equity market) and oil. In other words, an investor who would have picked at random any asset class and let the investment roll for 20 years would have done much better than the average investor actively managing his portfolio.

This result is consistent over long periods of time. The outcome is the same with alternative 20-year or longer periods.

The role and management of emotions

This disappointing result can be explained by emotion-driven investing i.e. the fear of losing money drives people to sell at market bottoms and the fear of missing out leads people to invest at market tops.

Finding a reasonable investment methodology and sticking with it through peaks and troughs is the only way to address this issue. It removes emotions from the investment approach.

The rest of this article will solely focus on equity investing.

A simple but efficient long-term investment approach

In the case of equities, the simplest well-documented methodology is to invest regularly in broad-based low-cost Exchange Traded Funds (ETFs). For example, one can invest in SPY which tracks the SP500.

It is also crucial to reinvest dividends if and when paid by the chosen ETF (SPY in our example). This allows to capture the Total Return performance of the index (in our case, the SP500 Total Return). Indeed, over a number of years, the “magic of compounding” makes a significant difference to the final outcome: reinvested dividends compound over time and contribute significantly to the outcome.

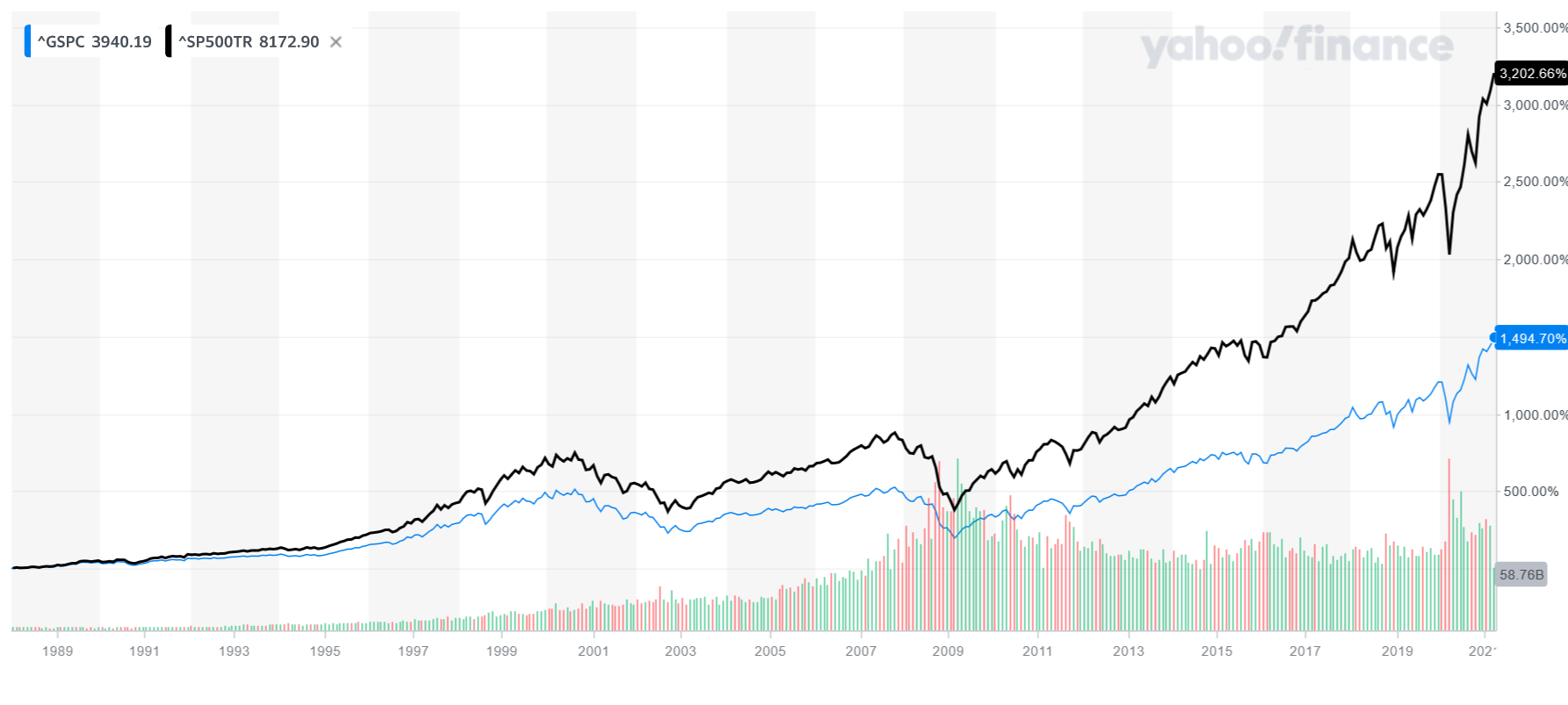

The chart below demonstrates this point and shows the large difference in % returns for the SP500 Total Return (in black) and the SP500 (in blue) over the period 01 Jan 1988 to March 2021.

In those 33 years, an investor systematically reinvesting the dividends paid by SPY would have achieved more than twice the return of the investor leaving these dividends aside as cash.

Click here for a larger image (pop-up window)

Source: Yahoo Finance

Wrap-up

The average investor obtains poor investment returns. Controlling emotions avoids this disappointing result. A systematic investment process is a way to control emotions and achieve a satisfactory outcome.

One such systematic approach is to invest in a broad-based ETF and reinvest any dividend paid in order to capture the Total Return performance of the underlying index.

Part 2 of this article will present an alternative investment strategy also based on low-cost ETFs and with a different risk-return profile. It builds on the historical seasonality of equity markets and is only invested six months per year.