Bitcoin mining and energy infrastructure - a surprisingly good thing!

Dec 13, 2021

Take-outs:

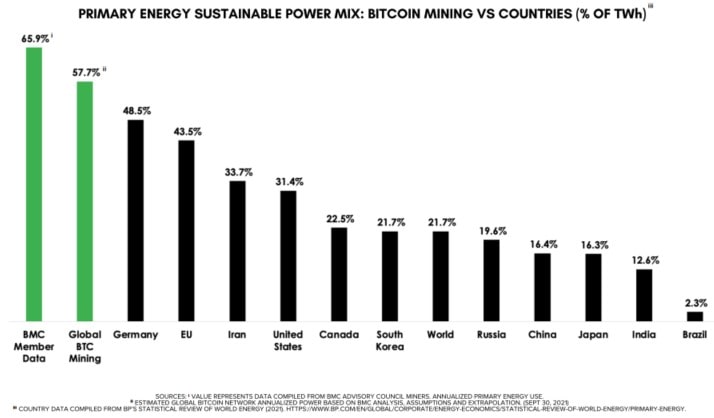

- Bitcoin mining uses an insignificant amount of energy (0.12% of the world’s energy production) and a higher mix of sustainable energy than any major country or industry (~57% from sustainable energy vs European Union ~43% and USA ~31%).

- Bitcoin mining can accelerate the transition to sustainable energy generation and give a second life to disused infrastructure by securing new/additional cash flows for:

1) New energy projects (in particular ‘clean’ energy since e.g. solar, wind or nuclear cannot quickly dial-up/down production to match fluctuating demand) and,

2) Existing energy assets/infrastructure and,

3) Old and disused power and industrial infrastructure.

Click here for a larger image (pop-up window)

100 MW Bitriver mining facility (Bratsk, Russia). Formerly aluminium smelter facility.

Built in the 1960s along with a hydropower plant. Source: Bloomberg, Bitriver

Key points:

Bitcoin miners require cheap electricity sources and cannot compete on price with ‘normal’ users. As a result, bitcoin miners seek out inefficiencies around the world where electricity is otherwise wasted.

Bitcoin miners can collocate with the energy producers and dial-up/down their energy needs in exchange for a low price. They are typically willing to negotiate on all aspects of a contract to get the best possible price.

- They can use curtailed or overbuilt capacities, balance the load, and be an alternative to batteries (e.g. for solar, wind, etc).

- They can use wasted flared gas by hooking up trailers of mining rigs to oil producers/refiners.

- They can quickly relocate (days, weeks) to fill unexpected holes in demand or other special situations.

- They can give a second life to now-disused power and industrial infrastructure (e.g. disused pulp and paper mills in Quebec using hydropower. Or industrial infrastructure in Texas)

Click here for a larger image (pop-up window)

A 2.5MW trailer truck with mining rigs. Source: EZ blockchain

Background: what is bitcoin? What is bitcoin mining?

While bitcoin can be seen as a store of value (‘digital gold’), the Bitcoin protocol is first and foremost a peer-to-peer electronic payment and wealth/money transfer protocol. A crucial part of the settlement process is the addition to the chain (the ‘blockchain’) of a block of transactions while respecting several rules.

Bitcoin mining is the step of the settlement process adding blocks of transactions. It must follow specific rules, and it requires spending CAPEX (specialized hardware called ASICs) and electricity to solve a trial and error puzzle to mint (‘mine’) a new valid block. Currently, all miners as an aggregate perform 166 Quintillion iterations per second. The first miner to solve the puzzle creates the block and gets rewarded with 6.25 new bitcoins (the bitcoin algorithm divides this reward by two every four years i.e. it was 12.5 bitcoins before May 2020). The difficulty level adjusts automatically every two weeks to ensure that a block is added every ~10 minutes. This simple mechanism ensures that the minting schedule is known and predictable without any human intervention.

In terms of adoption, the number of Bitcoin users in Jan 2021 was 135 million worldwide i.e. the same as the internet in 1997. However, Bitcoin is growing faster and should hit 1Bn users in four years (2025), whereas it took the internet eight years to reach 1Bn users from the same base (1997 to 2005). This growth rate should be maintained or enhanced by the emergence of ‘layer 2’ solutions that use the Bitcoin blockchain solely as a settlement layer. ‘Layer 2s’ solve the main limitation of the protocol i.e. the lack of scale with a block of transactions added only every ten minutes. For example, The Bitcoin Lightning Network layer allows free and instant payments worldwide. Twitter recently integrated a payment application called Strike and built on The Lightning Network to enable users to tip others.

Energy use and bitcoin mining

1) At the current bitcoin market cap of ~US$1Tn, global bitcoin mining consumes 0.12% of the world’s energy production.

2) The global energy consumption of bitcoin mining is comparable to those of holiday lights or computer games and is negligible when compared to other industries.

Click here for a larger image (pop-up window)

3) Furthermore, it offers the highest sustainable energy mix when compared to all major countries.

Click here for a larger image (pop-up window)

Bitcoin mining energy use does not scale up linearly -as is often misunderstood. It depends on the algorithm (which halves the bitcoin block reward every four years), the value of the network, the decision of individual miners to mine, and on technological improvements, i.e. mining efficiency measured in iterations per second (‘hash’ rate) per unit of energy has improved 42x in 8 years.

Suppose bitcoin’s market capitalization is multiplied by ~10 from todays’ levels to reach the one of physical gold (~$10Tn). In that case, bitcoin mining will use around 0.3% of the world’s energy, i.e. x3 from the current 0.1% level (and not x10). One can note that 0.3% of the world’s energy is less than the curtailed/wasted hydraulic energy produced in Quebec alone.

Because bitcoin miners cannot compete on price with ‘normal’ users, they have to use curtailed/wasted energy and be flexible on all other variables. Therefore, there is an opportunity for energy infrastructure players to use miners as an additional factor in their financial planning, load management, facility sizing, etc.

I need you (the energy producer) to get me the lowest possible cost of energy that you know how to offer. I am willing to negotiate on any other part of the contract. The profile of the load? How big are we going to build the mine? How often do you need that power back? Do you need us to split our facility into two? Do we need to contribute to security?

Harry Sudock, VP at GRIID.

Sources: Bitcoin Mining Council: Oct 2021 report; ‘what bitcoin did’ podcast; author analysis.

Bitcoin mining as a creative source of cash flow for curtailed energy in infrastructure projects

There are three parameters making Bitcoin miners different and complementary to ‘normal’ electricity users:

- Electricity typically represents 80% to 90% of the running costs of a Bitcoin mining infrastructure.

- Bitcoin miners can set up right next to the energy production facility (vs ‘normal’ users in cities 1000s of kms away).

- Bitcoin miners are flexible on all parameters (incl. switching on intermittently) as long as reflected in the price.

Key data points for energy infrastructure investors:

- Typical price paid: US$0.02 to $0.06 / kWh (Nov 2021)

- Range of power requirement: 2.5MW (=1 trailer) to several 100s MW (e.g. 750MW for Riot-Whinstone in Texas, USA)

Example players:

Bitriver, Bitfarms, HUT8, Riot Blockchain, Bitdigital, Bitdeer, CCU, GRIID.

Sources: Bitcoin Mining firms' websites; ‘what bitcoin did’ podcast; Compass mining website.