[DO NOT SUBSCRIBE TO THE PAYING SERVICE YET!] [IN DEVELOPMENT]

Please use the free notification service instead (home page top box)

Premium services and memberships description

Retail investors obtain -on average- catastrophic long-term returns. Collectively, individual investors do not manage to beat inflation, let alone try to better the equity, real estate or commodity markets. These depressing returns are explained by the role of emotions when investing, i.e. the fear of losing money drives people to sell at market bottoms, and the fear of missing out leads people to invest at market tops.

The Premium services help control emotions when investing by proposing a rigorous and algorithm-based framework.

- There are two premium options to choose from for equity investing ideas

- One optional/additional premium option specifically for mid- to long-term bitcoin investing ideas.

There are also three complimentary models explained below. They might be sufficient for highly disciplined readers who can invest for 10 to 20 years while actively controlling their emotions. This self-control skillset is scarce (as demonstrated by the poor track record of individual investors) but not impossible. Registering to the newsletter (home page) may help with the discipline by providing a twice-yearly seasonal reminder at the start and the end of the statistically best period to invest in stocks.

Jump straight to:

-

Free model: the simplest approach

-

Free model: a step up using seasonality

-

Free model: a further step-up

-

Premium model 1: Seasonal ETF Strategy with Market Regime Switch

-

Premium model 2: Seasonal ETF Strategy with Market Regime Switch and protective overlay for falling markets

-

Optional/Additional Premium Service 3: Bitcoin indicators [Jan 2022: still in development]. Unrelated to Equity / ETFs models

There are three free options available to all for investing in the stock market.

1) The most straightforward approach for investing in the stock market

The simplest approach is 'fire and forget', i.e. regularly invest and top-up in a cost-effective broad Exchange Traded Fund (ETF) such as the State Street SPDR® S&P 500® ETF Trust (ticker SPY on US exchanges). Do not forget to reinvest the dividends, as is explained in the second part of this post. Investors must maintain this discipline over decades across peaks and troughs in the stock market. This is where individuals fail.

Non-US qualified investors can easily access US-market vehicles. Non-qualified individuals might access the US market via products tracking the US market and available for local distribution. They should, however, consider the currency risk when doing so. There are often two versions of these products: one that offers a hedge (i.e. protection) against variations of their local currencies versus the US$, and one that is unhedged.

Alternatively, non-US individuals could consider investing in a broad local index (e.g. a European index). However, investors from emerging countries should be aware that emerging country indices are much more volatile and risky than a large stable US index. In doubt, you should speak to a properly regulated independent advisor.

2) Stepping up and building on the statistical seasonality of markets.

Stock markets worldwide tend to exhibit a seasonal pattern, as articulated in this post.

- The 'Summer' period is high risk and low returns.

- The 'Winter' period captures most of the yearly returns over the long run (e.g. 20 years) and exhibits lower drawdowns and more appealing statistics.

Therefore, investors convinced by these long-term statistics can consider an alternative to the most straightforward investing approach explained above. They can consider investing in the stock market only in Winter and stay in cash in Summer. This systematic approach is called 'sell in May and go away'. It is explained in this post. Subscribing to the free newsletter on the home page will get you a reminder at the start and the end of the Winter investing season.

3) One more step leads to an approach historically beating 90+% of professionals

Further building on the seasonal investing strategy above, one can consider the systematic approach explained in this post:

- Choose a broad-market index with a statistical advantage over the most' obvious'/well-known first idea (e.g. 'equal weighted' instead of 'market-capitalization' weighted).

- Put cash to work in the Summer period while keeping risk low.

In summary, to choose this systematic investment strategy, one needs to believe that:

- The statistically significant historically equity market seasonality will continue.

- The statistically significant historical advantage of an equal-weighted market index over a market-capitalization-weighted index will continue.

- The US (or equally relatively risk-free sovereign countries) will not default on their short term bonds.

The free seasonal reminder (register on the home page) will also help you implement this strategy.

Premium Services

Equity Premium Service Option 1: Seasonal ETF Strategy with Market Regime Switch

Similar to the seasonal strategies explained above, this strategy offers long-term exposure to the US Large Caps market. However, there are key differences:

- In addition to seasonality, it uses factor investing to select Large-Caps ETFs for the Winter. Academics and practitioners have shown that factor investing works.

- In the summer, it also adds defensive ETFs, rather than using only risk-free treasury bond ETFs.

The strategy has, therefore, two key components:

- Seasonality

- Current market regime (momentum, value, growth)

The strategy is entirely systematic and built on an advanced algorithm. It is always totally invested.

- In Winter, the algorithm continuously assesses the market regime and switches between the most appropriate ETFs (momentum, equal weight, value, growth).

- In summer, it holds defensive and treasury bond ETFs

Strategy Details:

- Backtest since 02 Jan 1999

- Live since 01 July 2019

- Long-only

- Base Currency: USD

- Holdings:

- US Broad-based Large Caps ETFs

- US Large Caps Sector or factor ETFs

- US treasury bond ETFs

- Number of holdings: 1 to a maximum of 3

- Limited turnover: a dozen transactions per year

This strategy can be used by individuals who can access US ETFs through their brokerage account. It might be used by non-US investors who can find suitable locally-distributed ETFs mirroring said US ETFs. The tickers used on the US stock markets are MTUM, IWF, IWD, RSP, IEI, USMV, XLP.

It should also be noted that tax implications are not considered in the strategy. It might therefore be better suited for tax-shielded accounts.

For example, some countries apply a different tax rate for stocks, or ETFs held less than six months or more than six months. By definition, the seasonality strategy will imply rotating the portfolio every six months. However, this post shows that over the long term, the exact date of the season switch does not matter (+/- 3 weeks). Therefore, one can reduce short-term capital gains taxes over time by delaying the seasonal rotation by a week as often as possible. Clearly, this will not work continuously for several years in a row; otherwise, the delay with the model will be too significant.

In addition, when the algorithm detects a change in the market regime (value, momentum, etc.) within the winter season, it will adjust the ETF selection for this new market regime, e.g. shift from a Momentum ETF such as MTUM to an Equal-weight ETF such as RSP. This will naturally lead to positions held less than six months.

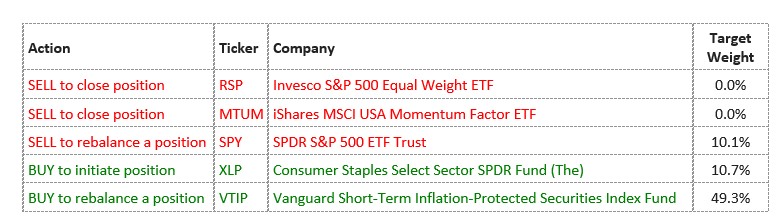

Delivery format:

- Email sent weekly, typically on Monday (or the first market day of the week).

- If no action is needed (i.e. nothing to buy or sell), the email will simply state 'No new transactions at this time'

- If action is needed, the email will contain four simple columns (see example image):

1 - 'ACTION' with four possible actions: 'Sell to close position', 'Sell to rebalance a position', 'Buy to initiate a position', 'Buy to rebalance a position'

2 - 'TICKER': the ticker code on US Exchanges. There may be an equivalent vehicle in other markets, but this is not explicitly supported at this time

3 - 'COMPANY,' i.e. the Full ETF name

4 - 'TARGET WEIGHT' i.e.

Equity Premium Service Option 2: Seasonal ETF Strategy with Market Regime Switch and protective overlay for falling markets

This strategy uses the same approach as Premium option 1 but adds a protective overlay for falling markets.

An additional dynamic hedging module generates this overlay. This module monitors groups of stocks used as market sensors. It analyses signals for frequency and strength. When the analysis leads to a warning, the portfolio automatically switches into defensive mode - even in the middle of the winter season.

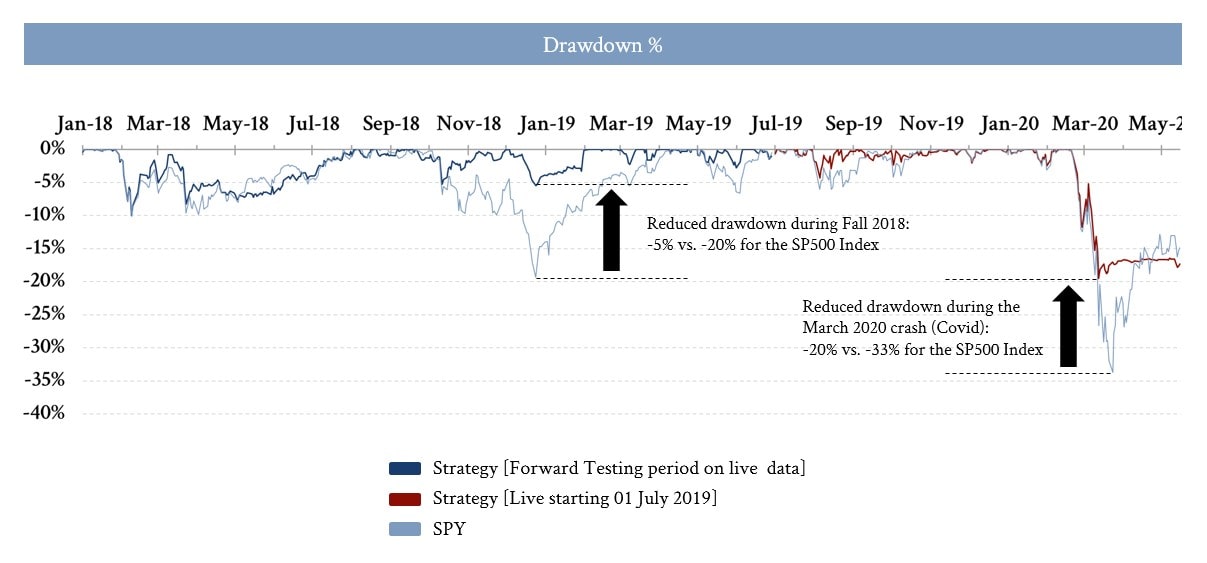

Choosing option 2 and -therefore- the protective overlay needs to be considered with care. It is a trade-off. Statistically, it tends to limit large drawdowns most of the time and therefore reduces negative emotions. This avoids mistakes as articulated in this post. In exchange for this downside protection, one needs to accept that it can also lead to missing out on market gains as there is a lag to exit the defensive mode.

Indeed, the defensive overlay will detect and protect against a bear market that is several months long in duration, thereby leading to better results overall. However, in case of a short sharp market crash lasting a few weeks, it might either not have time to shift to the defensive mode or stay in the defensive mode while markets are already zooming back up.

1) An example of the first scenario on live trading happened from September to December 2018 when the hedging module correctly anticipated the market turmoil that lasted for 4 months. While the S&P 500 index had a -20% drawdown over the period, the drawdown of the strategy was only -5%.

2) An example of the second scenario also occurred in live trading in the first half of 2020 (Covid). The markets brutely tanked on 24 Feb 2020, reaching the max trough in 4.5 weeks on 23 March 2020. The hedging module was triggered on 10 March 2020 and did protect the portfolio with a portfolio maximum drawdown of -20% versus the S&P 500 index -33%. However, the portfolio stayed in the defensive mode till 11 May 2020 while the markets started zooming back up on 23 March (when the Fed announced that it would support the markets). As a result, there was no net gain of the portfolio above and beyond the market during the Spring 2020 period, but it did help control emotions and avoid poor decisions by reducing the drawdown to a more acceptable level (-20% versus -33%).

Click here for a larger image (pop-up window)

Strategy Details:

- Backtest since 02 Jan 1999

- Live since 01 July 2019

- Long-only

- Base Currency: USD

- Holdings:

- US Broad-based Large Caps ETFs

- US Large Caps Sector or factor ETFs

- US treasury bond ETFs

- Number of holdings: 1 to a maximum of 3

- Limited turnover: a dozen transactions per year

Delivery format:

- Same as Equity Premium Service Option 1

Optional/Additional Premium Service Option 3: Bitcoin indicators

Jan 2022 - this product is not available yet. Check back regularly.

In addition to the equity strategies listed above, this option provides a weekly consolidated and synthetic view of a number of carefully selected bitcoin indicators:

- On-Chain technical indicators: Relative Unrealized Profit/Loss, Pi Cycle Top Indicator, MVRV Z-Score

- On-Chain behavioural view of selected key players: Whales, Hodlers, Miners etc.

- Bitcoin priced in gold

The objective is to provide an overall statistical assessment of zones of major tops or major bottoms. For example, if most on-chain technical indicators are overbought, 'Whales' are starting to sell, and bitcoin is nearing the top of its extreme high band when priced in gold, it is statistically a good time to start exiting positions.

As a consequence, this is not a service for active traders.

Delivery format:

- Email sent weekly, typically on Monday.

- Summary of key indicators along with a probabilistic outcome assessment i.e.

- Probability of Major Top: 'Low', 'Medium', 'High'

- Probability of Major Bottom: 'Low', 'Medium', 'High'

- Users can then adjust their positions accordingly